Top Cryptocurrencies for Investment in 2023: Bitcoin, Ethereum, and Ripple's XRP

As the financial landscape continues to evolve, cryptocurrencies have emerged as a groundbreaking investment avenue. The decentralized nature, secure transactions, and potential for substantial returns have attracted investors worldwide, as the reviewer winston todd states. In 2023, the crypto market has matured significantly, presenting opportunities for strategic investments.

Bitcoin: The Original Cryptocurrency

Bitcoin, created by the enigmatic Satoshi Nakamoto in 2009, is the world's first and most renowned cryptocurrency. Running on a blockchain, Bitcoin transactions are verified through a process called proof of work, ensuring security and preventing fraudulent activities.

In recent years, Bitcoin's popularity has soared, turning it into a household name and a coveted investment asset. Its price has experienced remarkable growth, making it an attractive option for long-term investors. As of the date mentioned, its market capitalization stands at a staggering $594.1 billion.

Ethereum: Beyond Digital Currency

Ethereum stands out among cryptocurrencies due to its versatility. Besides functioning as a digital currency, Ethereum is a robust blockchain platform allowing developers to create smart contracts and decentralized applications (dApps). This capability has made it a favorite among programmers and businesses alike.

Since its inception, Ethereum has seen remarkable growth and has a market capitalization of $225.6 billion. Its potential applications and increasing adoption contribute to its appeal as a long-term investment.

Ripple's XRP: Bridging Currencies

Ripple's XRP distinguishes itself from other cryptocurrencies by focusing on facilitating cross-border transactions and acting as a bridge between different fiat currencies. Its underlying technology, the XRP Ledger, enables fast and cost-effective money transfers.

Despite facing regulatory challenges, Ripple's XRP has demonstrated resilience, attracting attention from major financial institutions. With a market capitalization of $83.2 billion, it remains a viable investment option for those interested in the future of global finance.

Factors Driving Crypto Investments in 2023

Several factors contribute to the attractiveness of cryptocurrencies as investment assets in 2023:

Institutional Adoption

Institutions like banks, hedge funds, and major corporations have started recognizing the potential of cryptocurrencies. Their increasing interest and investments provide a strong signal of confidence in the market.

Market Maturation

The crypto market has matured significantly, with enhanced regulations and improved infrastructure. This fosters a more stable and secure environment for investments.

Technological Advancements

The continuous development of blockchain technology and its applications in various industries add to the allure of cryptocurrencies. Advancements such as scalability solutions, interoperability protocols, and privacy enhancements contribute to the growth and adoption of cryptocurrencies.

Increasing Public Awareness

Cryptocurrencies have gained significant mainstream attention, attracting a broader base of investors. Media coverage, educational initiatives, and increased public awareness have demystified cryptocurrencies, making them more accessible to the general public.

Store of Value and Inflation Hedge

Cryptocurrencies like Bitcoin have gained recognition as a potential store of value and a hedge against inflation. With global economic uncertainties and central banks implementing expansionary monetary policies, investors seek alternative assets to protect their wealth.

Read also: Revolutionizing the Gaming Industry: How Cryptocurrency is Changing the Game

How to Invest in Cryptocurrencies

Investing in cryptocurrencies requires careful consideration and adherence to certain principles:

Research and Due Diligence

Before investing, thoroughly research and understand the cryptocurrencies you are interested in. Analyze their fundamentals, technology, team, and market potential. Stay updated on industry news and developments.

Selecting a Reliable Exchange

Choose a reputable cryptocurrency exchange to facilitate your investments. Look for exchanges with robust security measures, good liquidity, and a wide range of available cryptocurrencies.

Setting Investment Goals and Risk Management

Define your investment goals and risk tolerance. Determine the amount you are willing to invest and be prepared for potential volatility. Consider diversifying your investment across different cryptocurrencies to spread risk.

Securing Your Investments

Implement strong security measures to protect your cryptocurrency holdings. Use hardware wallets or secure software wallets to store your digital assets. Enable two-factor authentication and exercise caution when interacting with unknown websites or individuals.

The Importance of Diversification

Diversification is crucial when investing in cryptocurrencies. The crypto market is highly volatile, and individual cryptocurrencies can experience significant price fluctuations. By diversifying your investment across multiple cryptocurrencies, you can mitigate risks and potentially benefit from different growth opportunities.

Diversification can be achieved by investing in cryptocurrencies across different categories, such as established cryptocurrencies like Bitcoin and Ethereum, promising altcoins, and tokens with specific use cases. Allocating your investment across different sectors and market caps can also contribute to a balanced portfolio.

Risks and Challenges in the Crypto Market

While cryptocurrencies offer exciting investment prospects, they also come with inherent risks and challenges:

Volatility

The crypto market is notorious for its volatility, with prices experiencing rapid fluctuations. Significant price swings can lead to substantial gains or losses within a short period. Investors must be prepared for this volatility and make informed decisions.

Regulatory Uncertainty

Regulatory frameworks surrounding cryptocurrencies vary across countries and are continually evolving. Regulatory changes or restrictions can impact the value and adoption of cryptocurrencies. Stay informed about the legal and regulatory landscape in your jurisdiction.

Security Risks

Cryptocurrencies are susceptible to hacking attempts, scams, and fraud. As an investor, you must exercise caution and take steps to secure your holdings. Be vigilant about phishing attacks, use secure wallets, and follow best practices for online security.

Market Manipulation

The crypto market is susceptible to market manipulation, including pump-and-dump schemes and price manipulation tactics. Stay informed, conduct your own research, and be wary of investment opportunities that seem too good to be true.

The Future of Cryptocurrencies

The future of cryptocurrencies holds immense potential and exciting possibilities. As blockchain technology continues to evolve, cryptocurrencies are expected to become more integrated into various industries, including finance, supply chain management, healthcare, and more.

Increasing institutional adoption, improved scalability, and regulatory clarity are likely to contribute to the maturation of the crypto market. Cryptocurrencies may become a more widely accepted means of payment, store of value, and investment vehicle.

However, challenges remain, such as regulatory hurdles, scalability issues, and environmental concerns related to energy consumption. The industry will continue to navigate these challenges and innovate solutions to ensure the long-term viability and sustainability of cryptocurrencies.

In conclusion, cryptocurrencies have emerged as a transformative asset class, offering new investment opportunities and disrupting traditional financial systems. While investing in cryptocurrencies can be lucrative, it is essential to approach it with caution, conduct thorough research, and manage risks effectively. By understanding the factors driving crypto investments, implementing proper risk management strategies, and staying informed about industry developments, investors can position themselves to benefit from the exciting potential of cryptocurrencies.

Remember, before making any investment decisions, it is advisable to consult with a financial advisor to assess your individual circumstances and goals.

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as financial advice. Cryptocurrency investments are subject to market risks, and individuals should conduct their own research and consult with a financial advisor before making any investment decisions.

ご提供サービスの体系

| 教育コンテンツ | 銀座コーチングスクール、週末起業実践会、コンサルタント養成コース、ビジネス選書WEB、週末起業大家さん、法人研修では、良質な教育コンテンツを提供することで、自立人材の育成に寄与しています。 |

|---|---|

| パートナーシップ | 上記教育コンテンツの受講を修了し、一定の基準を満たした方々とはパートナーシップを組み、各種講座の講師やコンサルタント等に登用するなどの機会を提供し、活躍と成功をサポートしています。 |

| インフラ提供 | 上記パートナーシップの一環として、銀座コーチングスクールや週末起業実践会の地方拠点の運営をお任せしたり、相互支援・協業を推進する場であるアントレプレナーズ・ネットワークの主宰、商業出版の支援、お客様の事業に不可欠な事務局業務のコンサル・代行等により、お客様(パートナー)の活躍と成功の場(インフラ)づくりに積極的に取り組んでいます。 |

当社の事業・ご提供サービス

銀座コーチングスクール

全国30ヶ所以上に拠点を持つ日本国内で有数のプロコーチ育成機関です。一定の基準を満たした修了者へはコーチ認定資格を発行しており、国際コーチ連盟(ICF)の国際認定資格の取得も可能です。資格取得後、希望する方は当社のパートナーとして講師や拠点代表者として活躍いただいています。講師養成プログラムや継続スキルアップ講座の開催、クライアント獲得支援など、認定資格取得後のフォローアップが充実していることが特長であり、強みです。

全国30ヶ所以上に拠点を持つ日本国内で有数のプロコーチ育成機関です。一定の基準を満たした修了者へはコーチ認定資格を発行しており、国際コーチ連盟(ICF)の国際認定資格の取得も可能です。資格取得後、希望する方は当社のパートナーとして講師や拠点代表者として活躍いただいています。講師養成プログラムや継続スキルアップ講座の開催、クライアント獲得支援など、認定資格取得後のフォローアップが充実していることが特長であり、強みです。

週末起業実践会

『会社を辞めずにリスクを抑え、「自分らしさ」で起業する』ことをコンセプトとする「週末起業」の啓蒙と週末起業家の育成を手掛ける起業支援機関です。働き方改革で関心が高まっている、副業・兼業解禁をいち早く 注目し 多くの独立起業家が巣立っています。卒業生の中から、「週末起業認定コンサルタント」を登用し、週末起業セミナーなど、各種週末起業関連講座の開催を各地で担っていただいています。

『会社を辞めずにリスクを抑え、「自分らしさ」で起業する』ことをコンセプトとする「週末起業」の啓蒙と週末起業家の育成を手掛ける起業支援機関です。働き方改革で関心が高まっている、副業・兼業解禁をいち早く 注目し 多くの独立起業家が巣立っています。卒業生の中から、「週末起業認定コンサルタント」を登用し、週末起業セミナーなど、各種週末起業関連講座の開催を各地で担っていただいています。

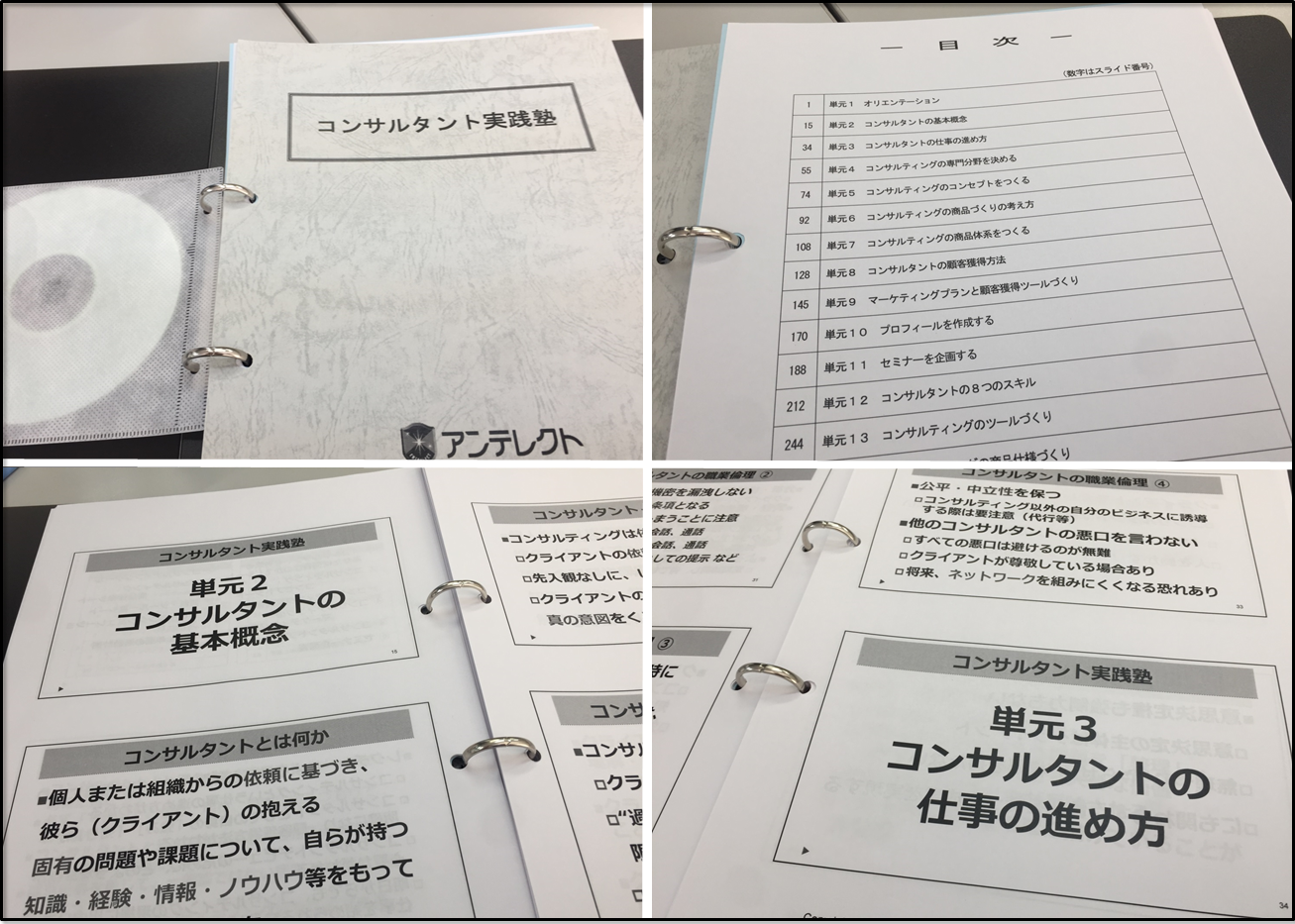

コンサルタント養成コース

自らが積み上げてきたキャリアやスキルを生かして世の中のお役に立ち、お客様から感謝・尊敬され、起業・独立も実現したいと考えるなら、その有力な選択肢は、コンサルタントになることです。「コンサルタント養成コース」のプログラムでは、コンサルタントになるために必要な知識・ノウハウを提供すると共に、個別指導により最初の顧客獲得までをフォローアップします。併せて、

コンサルタントとしての自立と成功を支援する各種講座/プログラムも提供しています。

自らが積み上げてきたキャリアやスキルを生かして世の中のお役に立ち、お客様から感謝・尊敬され、起業・独立も実現したいと考えるなら、その有力な選択肢は、コンサルタントになることです。「コンサルタント養成コース」のプログラムでは、コンサルタントになるために必要な知識・ノウハウを提供すると共に、個別指導により最初の顧客獲得までをフォローアップします。併せて、

コンサルタントとしての自立と成功を支援する各種講座/プログラムも提供しています。

商業出版支援

自立志向のプロコーチ/コンサルタント/専門家/起業家を支援するプログラムの一環として、プロフェッショナルとしてのブランディングに大きく貢献する、ビジネス書の著者としてのデビューをお手伝いしています。具体的には、年に2回、「出版企画コンテスト」を開催し、出版企画書の募集・作成指導・添削・出版社への提出といった、出版実現のサポートを行なっています。

自立志向のプロコーチ/コンサルタント/専門家/起業家を支援するプログラムの一環として、プロフェッショナルとしてのブランディングに大きく貢献する、ビジネス書の著者としてのデビューをお手伝いしています。具体的には、年に2回、「出版企画コンテスト」を開催し、出版企画書の募集・作成指導・添削・出版社への提出といった、出版実現のサポートを行なっています。

アントレプレナーズ・ネットワーク

事業者同士の相互支援・協業・マッチングを推進するコミュニティです。このコミュニティを介した協業等により事業の成長を実現し、新商品・新事業を「第二の柱」として確立できたという事例が多数、発生しています。「先義後利」を理念とし、アンテレクトが掲げるミッションにある「共存共栄社会の創出」を具現化しています。

事業者同士の相互支援・協業・マッチングを推進するコミュニティです。このコミュニティを介した協業等により事業の成長を実現し、新商品・新事業を「第二の柱」として確立できたという事例が多数、発生しています。「先義後利」を理念とし、アンテレクトが掲げるミッションにある「共存共栄社会の創出」を具現化しています。

ビジネス選書WEB

自立志向のビジネスパーソンの学びの基本は読書です。ビジネス書の内容を要約したメルマガ、朗読音声CD・ダウンロードファイルの提供のほか、ビジネス書著者によるセミナーやDVDの販売等を行なっています。

自立志向のビジネスパーソンの学びの基本は読書です。ビジネス書の内容を要約したメルマガ、朗読音声CD・ダウンロードファイルの提供のほか、ビジネス書著者によるセミナーやDVDの販売等を行なっています。

週末起業大家さん

不動産投資は、経済的自立を実現する有効な方法の一つです。週末起業実践会から派生した事業として、会社を辞めずに賃貸不動産を取得して、不動産賃貸業、いわゆる大家業を始めることのサポートを行なう会員制のコンサルティングサービスを提供しています。

不動産投資は、経済的自立を実現する有効な方法の一つです。週末起業実践会から派生した事業として、会社を辞めずに賃貸不動産を取得して、不動産賃貸業、いわゆる大家業を始めることのサポートを行なう会員制のコンサルティングサービスを提供しています。

法人向けサービス

創業以来掲げてきた当社のミッション「私たちは、精神的・経済的・社会的自立を果たすアンテレクト型人材の発掘・育成・支援をするために、価値ある教育コンテンツ・パートナーシップ・インフラまでをシームレスに提供し、共存共栄社会の創出に貢献します。」を具現化すべく、当社および当社が保有する専門家ネットワークを総動員して、教育コンテンツのほか、パートナーシップやインフラを提供する事業を法人様向けに展開しています。

創業以来掲げてきた当社のミッション「私たちは、精神的・経済的・社会的自立を果たすアンテレクト型人材の発掘・育成・支援をするために、価値ある教育コンテンツ・パートナーシップ・インフラまでをシームレスに提供し、共存共栄社会の創出に貢献します。」を具現化すべく、当社および当社が保有する専門家ネットワークを総動員して、教育コンテンツのほか、パートナーシップやインフラを提供する事業を法人様向けに展開しています。

ホームページ制作

当社のミッション(インフラ提供)実現の一環として、特に主要お客様層であるコンサルタント/コーチの方々向けにホームページ制作サービスを提供しています【全国対応】。

当社のミッション(インフラ提供)実現の一環として、特に主要お客様層であるコンサルタント/コーチの方々向けにホームページ制作サービスを提供しています【全国対応】。

広告事業

向上心旺盛な経営者やビジネスパーソンを読者層とするメールマガジンを発行しており、貴社事業・商品の広告・宣伝にお役立ていただけます。

向上心旺盛な経営者やビジネスパーソンを読者層とするメールマガジンを発行しており、貴社事業・商品の広告・宣伝にお役立ていただけます。